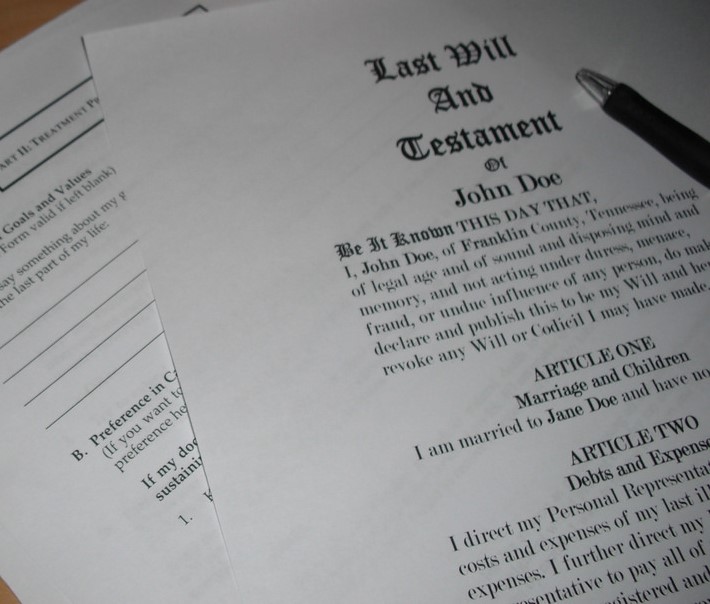

Leaving a valid will is one of the most important things you can do to ensure that your loved ones are taken care of after your death. However, wills are much simpler when you and your beneficiaries reside solely in Ontario. If there are multiple countries or even multiple provinces involved, you may want to consider using a Will in each jurisdiction.

The Probate Process

When you pass away with only a single Will, that Will is typically first probated in the jurisdiction where you resided. The probate process is where the court certifies the Will and the appointment of the executor. If you die while having assets in multiple jurisdictions, this probate process becomes more complicated as each jurisdiction can require their compliance with their probate process. If you only have one Will, then this process in the other jurisdictions will have to proceed after you first obtain probate in the first jurisdiction (typically, through a process called resealment in Commonwealth jurisdictions, where the court in other jurisdiction approves (or re-applies that court’s seal) to the probated Will of the first jurisdiction). When probate can take 6-8 months to obtain in Ontario, this can add significant delay in dealing with assets outside of the province or country.

Issues with a Sole Will

Time isn’t the only issue when you have assets in multiple jurisdictions. If you only have one Will, you leave the door open for a litany of potential validity issues within these processes. Different jurisdictions have different legal systems as well as different tax schemes, meaning that if your sole Will isn’t drafted properly, you may have to pay more in taxes in other jurisdictions. You may also be more susceptible to legal issues unique to each jurisdiction, which could include forced heirship, varying restrictions on property ownership, and illegitimacy laws. Different legal systems may also require different customs or formalities to be followed, something much harder to do with just one Will, as you would have to make sure the language and rules in your Will are appropriate for multiple jurisdictions.

Benefits of a Separate Will in each Jurisdiction

By using separate Wills in each jurisdiction, your estate is far more equipped to ensure legal compliance in each jurisdiction, while saving time and money. This allows you to easily tailor your estate wishes with the legal customs of another jurisdiction, preventing validity issues. It also ensures a more efficient probate process – allowing the Will in each jurisdiction to potentially be submitted at the same time, as opposed to having to wait for probate to be complete in one jurisdiction before your probated Will can be sent to the next jurisdiction for approval. As well, it allows you to potentially avoid additional probate fees or taxes, and allows for a more cost efficient resealment in the other jurisdictions.

If you have assets across multiple jurisdiction, including owning real estate in other Canadian provinces, then you should be considering the benefit of using a Will in each jurisdiction. The most important aspect of this type of planning is ensuring that all the Wills work together and do not revoke each other.